AM11 Sample Reports

|

Bank Reconciliation – Projected Cash Flow Reports

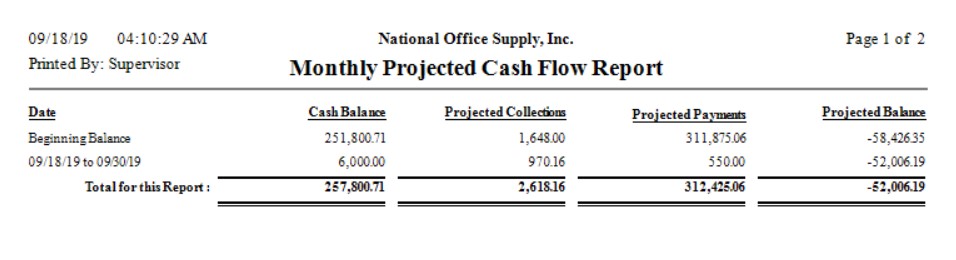

The Projected Cash Flow Reports is a set of reports that provide summary and detailed information about the transactions that comprise the projected cash balance, projected collections, and projected payments within a user-defined period. These reports facilitate review of the cash flow to help management in making informed decisions on purchases, loans, collection strategies, marketing efforts, hiring, etc. Each of these reports is especially designed to provide several options so you can narrow down data to the specific information needed. Each report is also presented in various report formats. Read the information below to get a closer look at each of the Projected Cash Flow Reports available in AccountMate. Projected Cash Flow Report The Projected Cash Flow Report pprovides summary information on the projected cash inflow, projected cash outflow, and projected cash balance. This report is useful for determining, at quick glance, the projected cash inflow from outstanding receivables, projected cash outflow for payables, as well as the projected cash balance at the end of the day or a certain period. You can set in the Projected Cash Flow > Setup tab the parameters for the data to be included in the report. You can choose whether to use the Due Date or Forecast Date to compare with the Report Date in order to group the transactions included in the report. You can generate the report for a specific individual record or a group of bank account records, customer records, and vendor records. You can specify the Report Cut-off Date for the transactions to be included in the report. You can opt to generate the report on a Daily, Weekly, Biweekly, or Monthly basis. You have the option to include the open credits and open debits in the report. You can also opt to include in the report the AP invoices with positive balance but being held for payment. You can choose not to show the past due AR invoices in the report, to show the past due AR invoices but exclude these from the projected collections amount calculation, or to include the past due AR invoices in the report. You can choose whether the AR invoices forecast dates be based on the later date between the forecast date and the AR invoice due date or to be based on the invoice date plus the average pay days in the customer record.

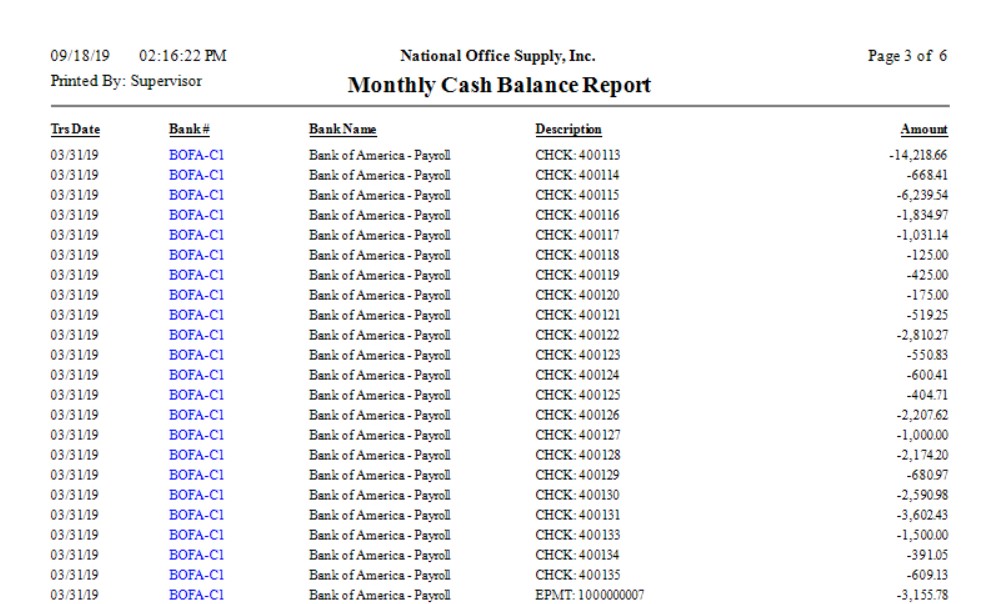

Projected Cash Balance Report The Projected Cash Balance Report provides detailed information on the transactions that comprise the projected cash balance at the end of the day or a certain period. This report is useful for quickly determining the projected cash balance after considering the actual cash balance, projected collections, and projected payments within the specified period. You can set in the Projected Cash Flow > Setup tab the parameters for the data to be included in the report. You can choose whether to use the Due Date or Forecast Date to compare with the Report Date in order to group the transactions included in the report. You can generate the report for a specific individual record or a group of bank account records, customer records, and vendor records. You can specify the Report Cut-off Date for the transactions to be included in the report. You can opt to generate the report on a Daily, Weekly, Biweekly, or Monthly basis. You have the option to include the open credits and open debits in the report. You can also opt to include in the report the AP invoices with positive balance but being held for payment. You can choose not to show the past due AR invoices in the report, to show the past due AR invoices but exclude these from the projected collections amount calculation, or to include the past due AR invoices in the report. You can choose whether the AR invoices forecast dates be based on the later date between the forecast date and the AR invoice due date or to be based on the invoice date plus the average pay days in the customer record.

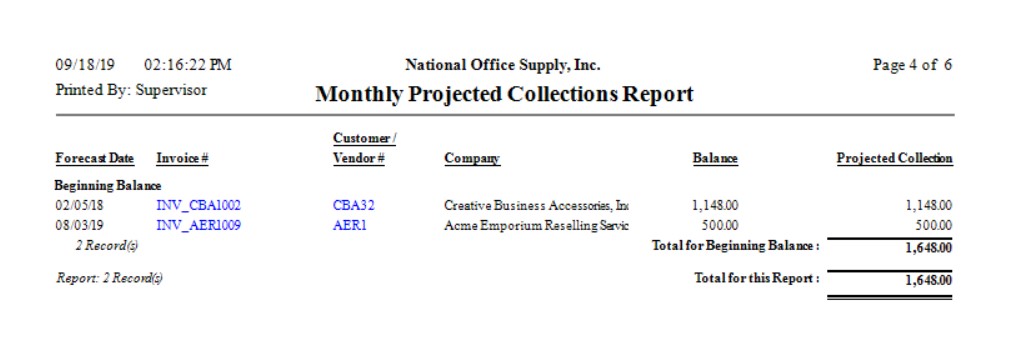

Projected Collections Report The Projected Collections Report provides detailed information on the transactions that comprise the projected collections amount at the end of the day or a certain period. This report is useful for quickly determining the projected collections from outstanding receivables within the specified period. You can set in the Projected Cash Flow > Setup tab the parameters for the data to be included in the report. You can choose whether to use the Due Date or Forecast Date to compare with the Report Date in order to group the transactions included in the report. You can generate the report for a specific individual record or a group of bank account records and customer records. You can specify the Report Cut-off Date for the transactions to be included in the report. You can opt to generate the report on a Daily, Weekly, Biweekly, or Monthly basis. You have the option to include the open credits in the report. You can choose not to show the past due AR invoices in the report, to show the past due AR invoices but exclude these from the projected collections amount calculation, or to include the past due AR invoices in the report. You can choose whether the AR invoices forecast dates be based on the later date between the forecast date and the AR invoice due date or to be based on the invoice date plus the average pay days in the customer record.

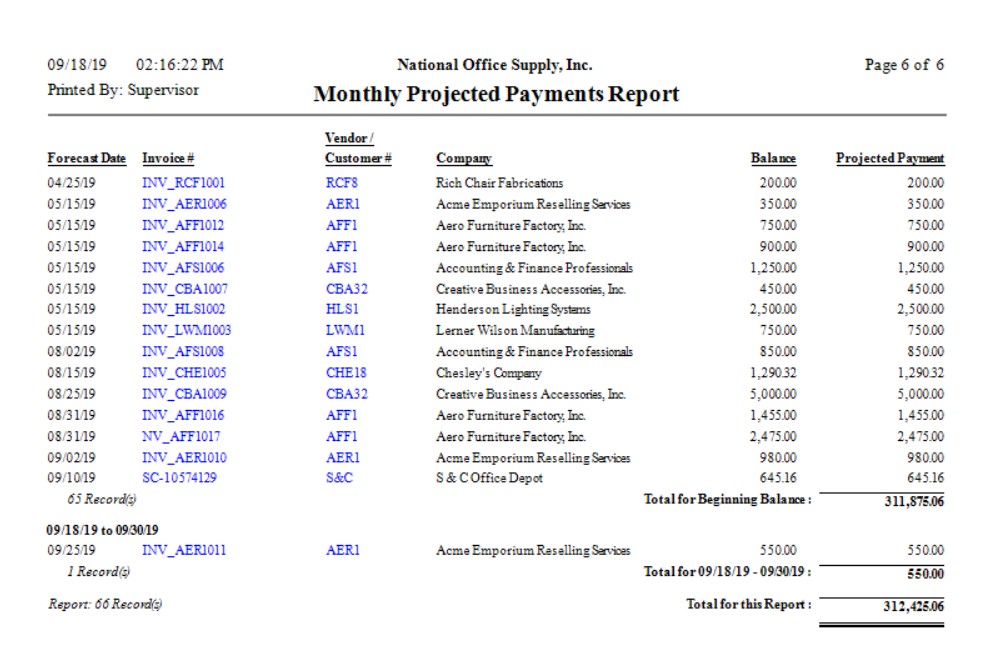

Projected Payments Report The Projected Payments Report provides detailed information on the transactions that comprise the projected payments amount at the end of the day or a certain period. This report is useful for quickly determining the projected payments for outstanding payables within the specified period. You can set in the Projected Cash Flow > Setup tab the parameters for the data to be included in the report. You can choose whether to use the Due Date or Forecast Date to compare with the Report Date in order to group the transactions included in the report. You can generate the report for a specific individual record or a group of bank account records and vendor records. You can specify the Report Cut-off Date for the transactions to be included in the report. You can opt to generate the report on a Daily, Weekly, Biweekly, or Monthly basis. You have the option to include the open debits in the report. You can also opt to include in the report the AP invoices with positive balance but being held for payment.

|